Leverage the benefit of our premium audit services

At BTC Insurance Services, LLC, we provide our business clients with premium audit reviews to ensure each policy in place reflects the operation and its exposures and the premiums charged by the carrier. We can help make sure your audit is done fairly and accurately.

For example, insurance policies with variable or fluctuating exposures, such as payroll, total cost, sales/receipts, and admissions have estimated exposures when underwritten. Typically, policies such as workers compensation and general liability policies are audited. We’ll review these policies to make sure the information is accurate and you are being charged accordingly.

Key Benefits of Audit Services

Our Audit Service Capabilities

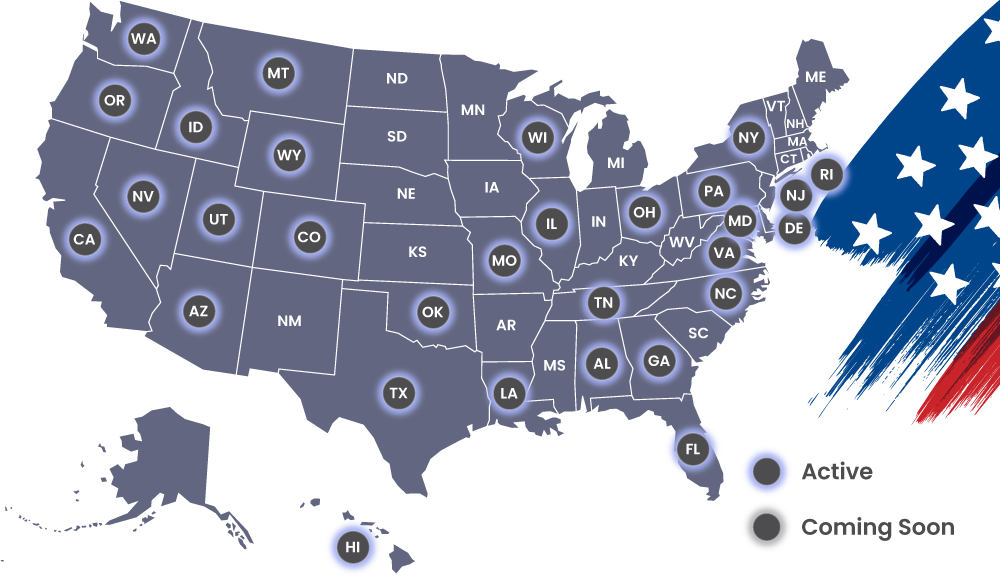

Serving: Utah Based

Licensed to conduct Business in following States

About BTC Insurance

For more than a decade, BTC Insurance has been committed to serving the insurance needs of the Utah community. Our approach is not only to provide you with insurance products that fit your exposures but to also help you put into place loss control and safety measures to mitigate and minimize losses. This takes experience and expertise – exactly what you will find with BTC Insurance.

© 2022. Copyright BTC Insurance | Privacy Policy Legal Notices

An expert representative will contact you immediately.

"*" indicates required fields