Personal Liability Insurance Coverage

We are often asked about what coverage is specifically provided by the liability portion of a homeowners insurance policy. We want to spend this post explaining what the coverage is and how it helps protect you. (Please keep in mind that every policy is different and that you should always refer to your specific policy […]

Insuring a Home-based Business

Did you know that, according to the Small Business Administration, more than half of all businesses in the United States are based out of the owners’ home? Many of these entrepreneurs assume their homeowners insurance will step in if they ever experience a property loss to their business equipment or a liability claim. Unfortunately, that […]

Auto Insurance Discounts Available to Utah Residents

We all know that insurance is an unavoidable cost that comes with the ownership of a vehicle. However, what many people don’t know is there are a number of insurance discounts available to help you save on your auto insurance premiums. Discount #1: Good Credit Many people don’t realize that most insurance companies now use […]

Earthquake Insurance Coverage

THE TOPIC With the recent earthquake in California, we through we would share some insight into earthquakes and insurance. Earthquake, at least for insurance purposes, is defined as a sudden and rapid shaking of the earth caused by the shifting of rock below the earth’s surface. Earthquakes are not covered by a standard homeowners insurance […]

5 Strangest Cases of Insurance Fraud

Did you know that insurance fraud costs insurance companies (and ultimately consumers) more than $50 billion dollars each year according to the FBI? This equates to approximately $500 in increased annual premiums to each one of us. Plus, when you start adding in lost productivity for businesses, ruined family finances, and the cost to investigate […]

7 Unusual Claims Covered by Homeowners Insurance

We know that homeowners insurance is designed to cover your home and it contents. Additionally, it provides liability protection for bodily injury and property damage for claims against you or members of your family. It may also provide coverage for the loss of use of your home in the event of a claim. However, […]

Does my credit score affect my insurance premiums?

What does my credit rating have to do with purchasing insurance? Everyone knows that credit scores are an evaluation of your payment history on a variety of consumer debt items like your home, credit cards, auto loans, etc. Credit scores are also used for a variety of other purposes such finding a place to live, […]

10 Ways Utah Residents Can Save on Home Insurance

Over the past few weeks we have been providing tips and tricks for saving on auto insurance. So this week we thought we would provide the top ways you can save money on your home insurance. 1. Ask for discounts The quickest way to save money on your home insurance is to take advantage […]

Why would I ever need car insurance if I don’t own a vehicle?

Did you know that vehicle ownership is actually declining, especially for people who live in urban areas? Many people now prefer to use a car-sharing service or just rent or borrow a car. The problem that arises is what to do for insurance in these instances where you don’t own a car, but use one […]

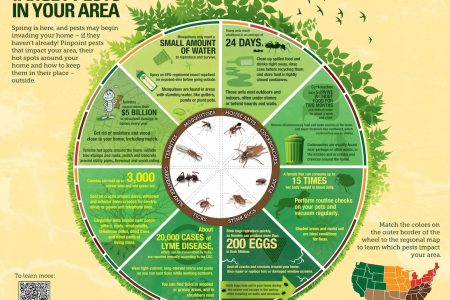

Insect Infestation Prevention

Did you know that insects like termites cause over $5 billion in structural damage every year? Even more important to note, though, is that most insect damage is NOT covered by your homeowners insurance policy. Most policies actually contain an exclusion that will not pay for damage caused by insects or rodents. It will, however, most […]